Understanding and Trading Barrier Options

Overview:

Options trading offers a variety of strategies to suit every market scenario—but when you add barrier options into the mix, you gain access to instruments that are both powerful and nuanced. Commonly used by institutional traders and hedging professionals, barrier options are a type of exotic option where the payoff depends on whether the underlying asset reaches a specific price level (the barrier) during its life.

In this guide, we’ll explore the mechanics of barrier options, how they differ from vanilla options, and strategies you can use to trade them effectively. Whether you’re hedging international risk, positioning around earnings volatility, or just seeking leverage with smarter cost control, understanding barrier options can give you an edge.

🧩 Section 1: What Are Barrier Options?

1.1 Barrier Options: A Definition

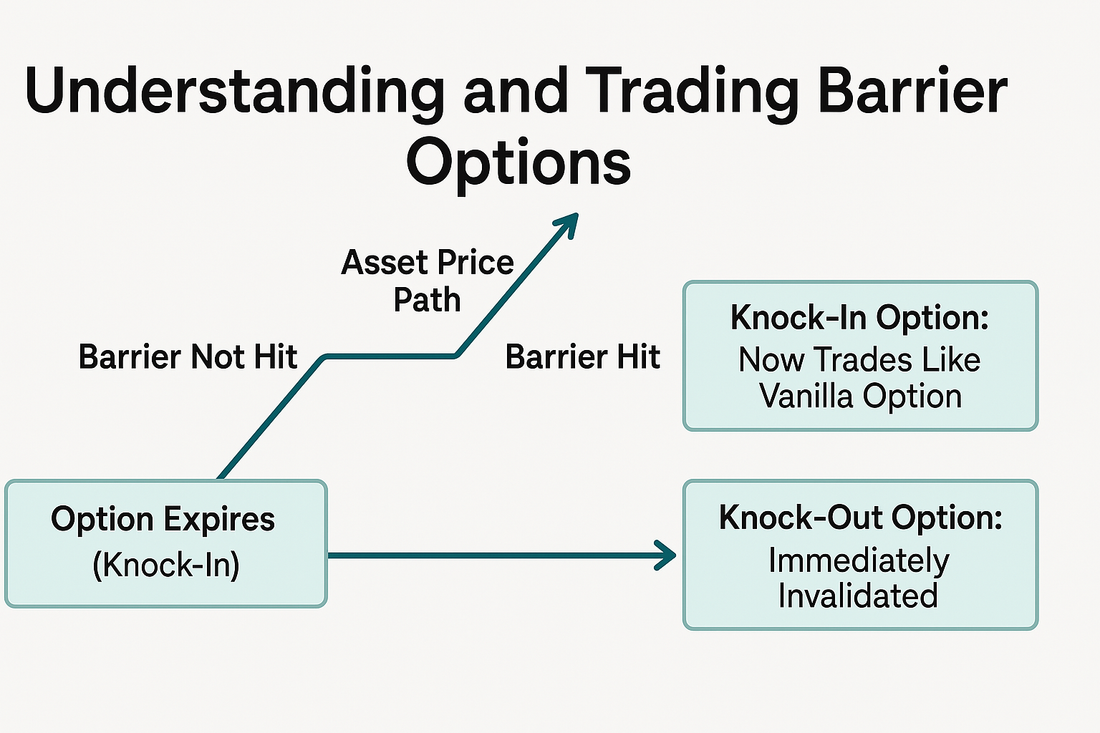

Barrier options are path-dependent options whose existence or payoff depends on the underlying asset hitting or not hitting a pre-defined barrier level. They either activate (knock-in) or expire worthless (knock-out) based on whether the barrier is reached during the option’s life.

There are four main types:

|

Type |

Activation Condition |

Behavior |

|

Up-and-In Call |

Activates if price rises |

Knock-in |

|

Down-and-In Put |

Activates if price falls |

Knock-in |

|

Up-and-Out Call |

Expires if price rises |

Knock-out |

|

Down-and-Out Put |

Expires if price falls |

Knock-out |

📌 Backlink Suggestion: Learn about vanilla vs exotic options for more context on where barrier options fit in.

1.2 Why Trade Barrier Options?

Barrier options are used to:

- Reduce premiums vs. vanilla options

- Target specific price paths

- Control hedging costs

- Express conditional market views

Barrier options are popular in forex, commodity, and volatility markets, where price behavior near a trigger level is especially relevant.

⚙️ Section 2: How Barrier Options Work

2.1 The Role of the Barrier Level

The barrier acts like a trigger:

- If it's reached (in knock-in), the option activates and becomes a regular option.

- If it's reached (in knock-out), the option is nullified—even if it was in-the-money.

Example:

- You buy an Up-and-Out Call on EUR/USD with strike 1.10 and barrier at 1.12.

If EUR/USD touches 1.12 during the option’s life—even briefly—the option knocks out and becomes worthless.

2.2 Pricing Barrier Options

The pricing depends on several factors:

|

Factor |

Impact on Barrier Option Pricing |

|

Proximity to Barrier |

Closer = more sensitive |

|

Volatility |

Higher vol = more barrier risk |

|

Time to Expiry |

Longer duration = more barrier risk |

|

Interest Rates |

Affects underlying drift |

Barrier options typically cost less than equivalent vanilla options because of the added uncertainty—they might never pay off.

2.3 Settlement and Monitoring

Barrier options can be:

- European-style: Only settle at expiry

- American-style: Monitored continuously throughout the contract life

And some may offer a rebate upon knock-out (e.g., $0.10 per contract) to partially offset the loss.

📌 Backlink: See our breakdown of options settlement types.

💡 Section 3: Trading Strategies Using Barrier Options

3.1 Strategy 1: Cost-Efficient Speculation

Use knock-in options to reduce premium when you expect a move but want to only pay if it happens.

Example:

- Buy a Down-and-In Put on oil futures if you think oil will drop but only want to risk capital if it breaks $70.

You pay less premium than a regular put because the barrier must be triggered to activate the option.

3.2 Strategy 2: Capital Preservation via Knock-Outs

Use knock-out options when you want to limit risk but expect the price to stay below/above a level.

Example:

- You sell a Up-and-Out Call on gold with a barrier at $2,050.

If gold spikes above that, the option knocks out and you avoid further loss.

Useful for:

- Trading tight ranges

- Selling premium with capped exposure

- Hedging correlated assets

3.3 Strategy 3: Event-Driven Positioning

Barrier options are perfect for short-lived, high-impact events (earnings, rate decisions, political events).

Trade Setup:

- Use a knock-in straddle: Long a call and a put, both with barriers at levels just outside the current trading range.

→ If the stock breaks either direction, one option activates.

This can give you cheap exposure to post-event volatility without overpaying for theta decay.

📌 Backlink: Learn more about event-driven options trading.

3.4 Strategy 4: Structured Hedging for Commodities/FX

Barrier options are used heavily in FX and commodities for precision hedging.

Example:

A coffee importer uses a knock-in put on Brazilian real (BRL/USD) to protect against BRL weakness—but only if the currency drops below 4.75.

The option saves premium and only activates if protection is needed.

📊 Illustration: Barrier Levels and Outcomes Diagram

🧠 Common Pitfalls and How to Avoid Them

❌ Mistake 1: Not Accounting for IV Impact

Barrier options are more sensitive to implied volatility than vanilla options. A change in IV can dramatically affect premium and barrier probability.

✅ Solution: Use IV analysis tools and model risk probabilities before execution.

❌ Mistake 2: Misjudging Barrier Distance

Placing the barrier too close can result in immediate invalidation. Placing it too far may reduce cost savings.

✅ Solution: Study historical volatility, ATR, and use barrier-to-spot ratios strategically (e.g., 5–7% away).

❌ Mistake 3: Overlooking Rebates or Terms

Some barrier contracts include rebates, others don’t. Some are daily monitored, some continuously monitored.

✅ Solution: Read the product specification closely—especially in OTC contracts or structured products.

🔗 Internal Backlinks for SEO Optimization

- How to Hedge with Options

- Understanding Options Greeks in Exotic Products

- Volatility and Options Pricing

- Exotic Options Strategies for Institutional Traders

🧪 Case Study: Using Barrier Options in Real-World Trades

Case Study: USD/JPY Forex Hedge

Trader: International fund exposed to Japanese Yen

Risk: Yen depreciating below 130

Strategy: Buys Down-and-In USD/JPY call

- Barrier: 130

- Strike: 132

- Outcome:

- If USD/JPY touches 130 → call activates

- If not, no premium lost

Result:

A precise hedge at a fraction of the cost of a regular call option.

✅ Summary: When and Why to Use Barrier Options

|

Scenario |

Barrier Strategy |

|

Expect breakout but want cheaper entry |

Knock-In Option |

|

Range-bound market w/ low risk tolerance |

Knock-Out Option |

|

Hedging only if risk threshold is breached |

Knock-In Hedge |

|

Speculation on event movement with limit |

Knock-In Straddle |

|

Need to reduce hedging cost |

Barrier with rebate structure |

Barrier options combine the flexibility of traditional options with precision control over activation and risk management. Mastering them adds another dimension to your trading arsenal.

🎯 Conclusion: Add Precision to Your Trading Toolbox

Barrier options give you targeted exposure, reduced costs, and condition-based payoffs. Whether you’re an advanced retail trader or an institutional investor, they allow for tactical plays that vanilla options simply can’t provide.

Understand them well, and you’ll unlock new hedging methods, risk mitigation tools, and trading strategies that bring you one step closer to financial freedom.

✅ Be A Precise Trader

At www.optionstranglers.com.sg we offer:

• In-depth live 1-1 sessions / group classes

• Trade examples and breakdowns

• Community mentorship and support

👉 Ready to upgrade your strategy and trade like a pro? Visit www.optionstranglers.com.sg and start your journey to financial freedom today.

Your future is an option. Choose wisely.

⚠️ Disclaimer:

Options involve risk and are not suitable for all investors. Always consult with a financial advisor before investing.