The Role of Options in Managing Commodity Investments

Overview:

Commodities like oil, gold, natural gas, and agricultural products are foundational to the global economy—and they’re also notoriously volatile. For traders and investors looking to profit or hedge against unpredictable swings, options provide a powerful toolkit. Options allow you to fine-tune risk, lock in gains, protect against adverse price movements, and amplify returns—all while maintaining a strategic edge.

In this comprehensive guide, we explore how options can be used effectively to manage commodity investments, from basic hedging techniques to more speculative plays. Whether you're a novice or a seasoned trader pursuing financial freedom, this article will help you integrate options with confidence into your commodity investing journey.

🌾 Section 1: Commodity Basics – What You’re Trading

1.1 What Are Commodities?

Commodities are raw materials or primary agricultural products that can be bought and sold, typically via futures contracts. They fall into two broad categories:

- Hard Commodities: Natural resources like oil, gold, silver, copper.

- Soft Commodities: Agricultural products like wheat, corn, coffee, soybeans.

1.2 How Commodity Markets Work

Commodities are traded globally through exchanges such as:

- CME Group (Chicago): WTI crude, gold, corn, soybeans

- NYMEX: Energy futures

- ICE (Intercontinental Exchange): Brent crude, cocoa, cotton

- SGX: Iron ore, rubber (for Southeast Asian traders)

Prices are influenced by:

- Supply-demand dynamics

- Geopolitical risk

- Weather patterns (for agri-commodities)

- Interest rates and USD strength

- OPEC policies, mining outputs, and export restrictions

📌 Backlink suggestion: For fundamentals, see our Commodity Market Primer for Options Traders.

1.3 Key Characteristics of Commodity Investing

- High volatility

- Geopolitical sensitivity

- Seasonal and cyclical trends

- Leverage available via futures, which options can enhance or hedge

⚙️ Section 2: Options Strategies for Commodity Traders

Options on commodities are either:

- Direct options on futures contracts (e.g., CL options on crude oil futures)

- Options on ETFs tracking commodities (e.g., GLD for gold, USO for oil)

Let’s break down how to use them.

2.1 Hedging Commodity Exposure with Options

A. Protective Puts for Downside Insurance

If you hold a long commodity position (say gold or crude oil futures), you can buy a put option to protect against a price drop.

Example:

You’re long 100 barrels of WTI crude oil at $80. Buy a $75 put for $1.50. If oil crashes to $70, you’re protected from further downside below $75.

📌 Backlink: Learn more about Protective Puts in Commodity Trading.

B. Covered Calls to Generate Income

If you’re holding commodity ETFs (GLD, SLV, DBA), sell calls against them to earn premium while waiting for prices to rise.

Example:

Long GLD at $190. Sell a $195 call for $2. Premium reduces your cost basis while maintaining upside.

2.2 Speculating with Leverage Using Options

A. Buying Calls and Puts for Directional Bets

Expect oil to spike after OPEC cuts? Buy a short-dated call on USO. Think corn prices will drop after harvest season? Buy puts on CORN ETF.

Pros:

- Limited risk

- High leverage

- No need to hold futures contracts

B. Straddles and Strangles for Event Volatility

Events like weather disasters, Middle East tensions, or Fed meetings can cause sharp commodity moves. Play both sides with:

- Straddle: Buy call + put at same strike

- Strangle: Buy call and put at different OTM strikes

Example:

Buy a strangle on USO before an OPEC+ meeting. If oil spikes or plunges, you profit.

2.3 Spreads for Smarter Risk Management

A. Vertical Spreads (Bull or Bear)

Expect a modest move in gold? Use a bull call spread:

- Buy GLD $185 call

- Sell $190 call

→ Reduces premium cost and caps profit/loss.

B. Calendar Spreads

Take advantage of different volatilities across months. Works well in seasonal commodities like natural gas or soybeans.

📌 Backlink: Explore Vertical and Calendar Spread Techniques.

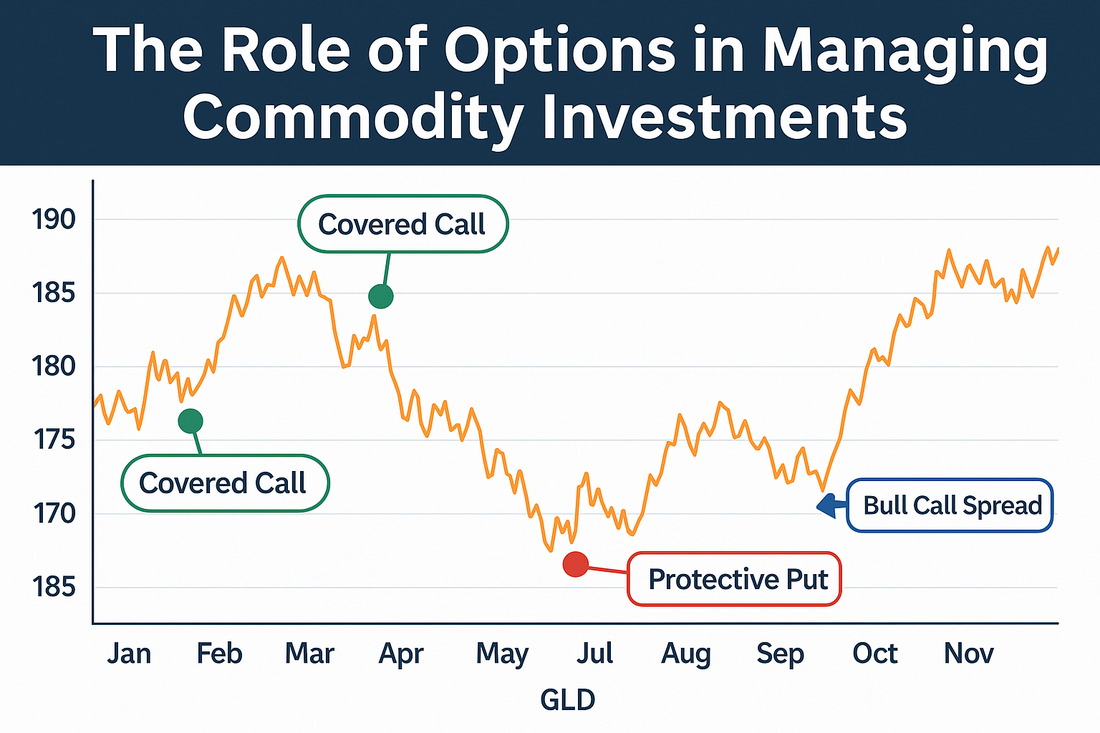

📊 Illustration: Commodity Price Chart with Options Overlays

⚖️ Section 3: Risk vs. Reward in Commodity Options

3.1 The Upside of Options in Commodity Trading

✅ Defined Risk: Maximum loss = premium paid

✅ No Margin Calls: Unlike futures

✅ Leverage: Control larger positions with less capital

✅ Income: Premium collection with strategies like covered calls

✅ Hedge Correlation Risks: Especially useful in inflation-hedged portfolios

3.2 The Risks to Watch For

🚫 Time Decay: Especially for buyers of out-of-the-money options

🚫 Low Liquidity in Niche Commodities: Watch bid-ask spreads

🚫 Volatility Crush: After big events (e.g., OPEC cuts already priced in)

🚫 Tracking Error: In ETF options vs. actual futures (e.g., USO vs WTI crude)

🚫 Complex Interdependence: Commodities are influenced by multi-variable factors (weather, politics, FX)

📌 Backlink: Understand Options Greeks for Commodity Traders.

3.3 Best Practices to Mitigate Risk

- Use defined-risk trades (e.g., vertical spreads)

- Monitor macro events: Weekly inventories, crop reports, geopolitical updates

- Size positions appropriately

- Journal your commodity options trades to identify patterns and improvements

📌 Backlink: See our guide on Managing Your Options Journal.

🧪 Real-World Case Studies: Commodity Options in Action

Case Study 1: Hedging Oil Volatility

Trader: Marcus, long crude oil futures

Action: Bought protective put at $75 when oil was at $82

Event: Russia-Ukraine peace talks deflated oil prices

Result: Oil dropped to $73, but he exited with minimal loss due to put protection

Case Study 2: Covered Calls on GLD

Trader: Priya holds GLD in her long-term retirement portfolio

Action: Sells $200 calls monthly at ~$2 premium

Outcome: Generates ~12% annual yield on GLD holding while capping gains

Case Study 3: Speculative Bull Spread on Corn

Trader: Alex expects corn prices to rise during planting season

Action: Bull call spread: Buy $85 / Sell $90 on CORN ETF

Result: Corn rose sharply → captured max profit with limited downside

📈 Recommended ETFs and Instruments for Commodity Options

|

Commodity |

ETF/Instrument |

Liquidity |

Strategy Fit |

|

Gold |

GLD |

High |

Covered calls, spreads |

|

Oil |

USO / WTI |

High |

Directional + hedging |

|

Silver |

SLV |

Medium |

Speculative calls |

|

Corn |

CORN |

Low/Med |

Seasonal spreads |

|

Natural Gas |

UNG |

High |

Volatility strategies |

|

Agriculture |

DBA |

Medium |

Income generation |

🔗 Internal Backlinks for SEO

- Using Options for Inflation-Hedged Portfolios

- Options Trading for Income Generation

- Hedging Techniques with Options

- Advanced Options Analytics

🎯 Conclusion: Take Command of Commodity Investments with Options

Commodities offer some of the most exciting yet challenging opportunities in the investing world. With the right application of options, you can smooth out volatility, lock in profits, and generate consistent income, all while controlling risk with precision.

Whether you're trading oil around OPEC announcements, hedging gold exposure in turbulent times, or selling calls on agricultural ETFs, options allow you to customize your exposure. The key is knowing your tools—and executing them with discipline.

Options empower the modern trader with strategic flexibility. In the commodity space, that’s not just helpful—it’s essential.

✅ Manage Your Investments Correctly

At www.optionstranglers.com.sg we offer:

• In-depth live 1-1 sessions / group classes

• Trade examples and breakdowns

• Community mentorship and support

👉 Ready to upgrade your strategy and trade like a pro? Visit www.optionstranglers.com.sg and start your journey to financial freedom today.

Your future is an option. Choose wisely.

⚠️ Disclaimer:

Options involve risk and are not suitable for all investors. Always consult with a financial advisor before investing.