Options Trading and Market Microstructure: A Closer Look

Introduction

In options trading, most market participants focus on strike prices, volatility, and expiration dates. But few explore the underlying architecture that drives price discovery and execution — a complex system known as market microstructure. This refers to the mechanisms, rules, participants, and infrastructure that determine how trades are executed, prices are formed, and liquidity is maintained.

Understanding market microstructure is essential for serious options traders. From bid-ask spreads and hidden liquidity to order routing and latency, these invisible forces can affect fill quality, slippage, and ultimately, your bottom line. This article demystifies market microstructure and shows how it directly impacts your options trading strategies.

Section 1: What is Market Microstructure?

1.1 Defining Market Microstructure

Market microstructure is the study of how markets operate at the transaction level, focusing on:

- Order types and execution mechanics

- Bid-ask spread formation

- Latency and information flow

- Role of market makers and liquidity providers

- Exchange architecture and routing protocols

In essence, it answers the question: How are prices formed and trades matched in real-time?

📌 Backlink Opportunity: Advanced Options Analytics: Tools and Techniques

1.2 Key Players in Microstructure

- Retail Traders – Use broker platforms to route orders to exchanges or market makers.

- Institutional Traders – Often use direct market access and smart order routing.

- Market Makers – Provide liquidity by continuously quoting bid and ask prices.

- Exchanges (e.g., CBOE, NYSE, NASDAQ) – Where trades are matched and cleared.

- High-Frequency Traders (HFTs) – Use speed advantages for arbitrage and liquidity capture.

Each participant shapes how trades get executed and how fast price adjustments happen — especially in options markets where pricing is complex and fragmented.

1.3 How Options Markets Differ from Equities

Options microstructure is more intricate than equities due to:

- Multiple strikes and expirations per underlying

- Thin liquidity across far-out contracts

- Wide spreads in OTM and LEAPS options

- Complex routing and auction systems

For example, SPY has over 1,000 active option contracts, each with varying levels of liquidity and volatility sensitivity.

📌 Backlink Opportunity: How to Trade Weekly Options

Section 2: Implications of Market Microstructure for Options Traders

2.1 The Bid-Ask Spread and Its Hidden Cost

The bid-ask spread is the difference between the highest price a buyer is willing to pay and the lowest price a seller will accept. In options:

- Narrow spreads = higher liquidity and lower cost

- Wide spreads = harder fills, greater slippage

Why this matters:

- Buying at the ask and selling at the bid can erode profits

- Legging into multi-leg spreads becomes more difficult

- Exotic or deep OTM contracts can carry implied slippage of 5%+

Pro Tip: Use midpoint orders and seek liquid expiries with tight spreads.

2.2 Order Flow and Liquidity Tiers

Liquidity isn’t evenly distributed in the options chain. It's concentrated around:

- Near-the-money strikes

- Near-term expirations

- Popular underlyings like SPY, AAPL, TSLA, QQQ

Order flow clustering leads to:

- Faster fills in liquid contracts

- Better price improvement via competition

- Better IV modeling from active trading

📌 Backlink Opportunity: How to Interpret Options Volume and Open Interest

2.3 Routing and Execution Quality

Most brokers route orders to market makers through payment for order flow (PFOF) systems. While this offers commission-free trades, it may result in:

- Inferior fill quality (subpar price execution)

- Order routing latency

- Delays in complex multi-leg order fills

More advanced brokers offer smart routing and direct-to-exchange execution, improving speed and transparency.

📌 Backlink Opportunity: Digital Tools and Software for Options Traders

2.4 Impact on Spread Strategies

Market microstructure affects spread trades due to:

- Leg slippage: When one leg fills and the other doesn't

- Queue priority: Orders placed earlier may still get skipped if not competitive

- Price improvement: Market makers may fill your spread at better-than-quoted prices — or worse

Best Practice:

- Use combo orders (e.g., vertical spreads) to ensure execution symmetry

- Avoid thinly traded spreads unless manually priced

2.5 Hidden Liquidity and Auction Mechanisms

Not all liquidity is visible in the Level 2 order book. Exchanges may use:

- Flash orders

- Price improvement auctions (PIAs)

- Complex order books for spreads

Understanding these mechanisms can help:

- Time entries for better fills

- Use limit vs. market orders strategically

- Gauge true liquidity depth

Section 3: Case Studies — Microstructure in Action

Case Study 1: Earnings Volatility and Order Book Skews

Stock: AAPL before earnings

Observation: 1-day ATM IV spikes from 40% to 80%

Microstructure Impact:

- Wide spreads emerge (from $0.10 to $0.50)

- Market makers pull liquidity ahead of announcement

- Gamma scalpers drive short-term volatility

Trade Consideration: Use calendar spreads or iron condors on liquid expirations to reduce microstructure risk.

📌 Backlink Opportunity: Options Trading During Earnings Season

Case Study 2: SPY Spread Fails to Fill Due to Slippage

Trade: Sell SPY 445/440 put spread for $1.00 credit

Order placed at midprice, market fluctuates

Issue:

- Bid drops before both legs fill

- First leg executes, second doesn’t

- Trader ends up with naked short put exposure

Lesson: Always use GTC limit orders on the spread, not leg-by-leg.

Case Study 3: Binary Options in Low-Liquidity Markets

Stock: Small-cap biotech before FDA announcement

Trade: Buy binary call with $100 payout

Issue:

- Only one market maker quoting

- $10 bid / $50 ask = 80% slippage

- Post-announcement IV crush leaves no exit window

Lesson: Avoid illiquid or one-sided binary markets with asymmetric microstructure.

📌 Backlink Opportunity: Exploring Exotic Options

Section 4: Practical Tips for Navigating Market Microstructure

✅ Trade Liquid Underlyings

Stick with options that exhibit:

- High open interest

- Narrow bid-ask spreads

- Deep multi-leg combo support

Popular choices: SPY, QQQ, AAPL, TSLA, NVDA, MSFT

✅ Use the Right Order Types

- Limit Orders: Control your price, reduce slippage

- Combo Orders: Better fill reliability for spreads

- Immediate or Cancel (IOC): For time-sensitive trades

- Fill or Kill (FOK): Prevent partial fills

📌 Backlink Opportunity: How to Launch Your First Options Trade

✅ Avoid Wide Spreads Unless Strategically Justified

Only trade wide-spread contracts when:

- The payoff is asymmetric and worth the entry cost

- You can wait for price to come to you

- You're using defined-risk strategies like butterflies or calendars

✅ Monitor Exchange Behavior and Auction Rounds

Exchanges may offer periodic price improvement rounds where:

- Your order can be matched better than market quotes

- Spread orders can clear at net credit rather than mark price

Set alerts for auction sessions when trading during pre-market or high-volatility windows.

✅ Be Aware of Latency and Routing Speed

Speed matters in fast markets — especially for:

- News-based scalps

- Event-driven option plays

- Multi-leg adjustments

Use brokers with smart routing, low-latency platforms, and real-time option chains.

📌 Backlink Opportunity: The Psychology Behind High-Frequency Options Trading

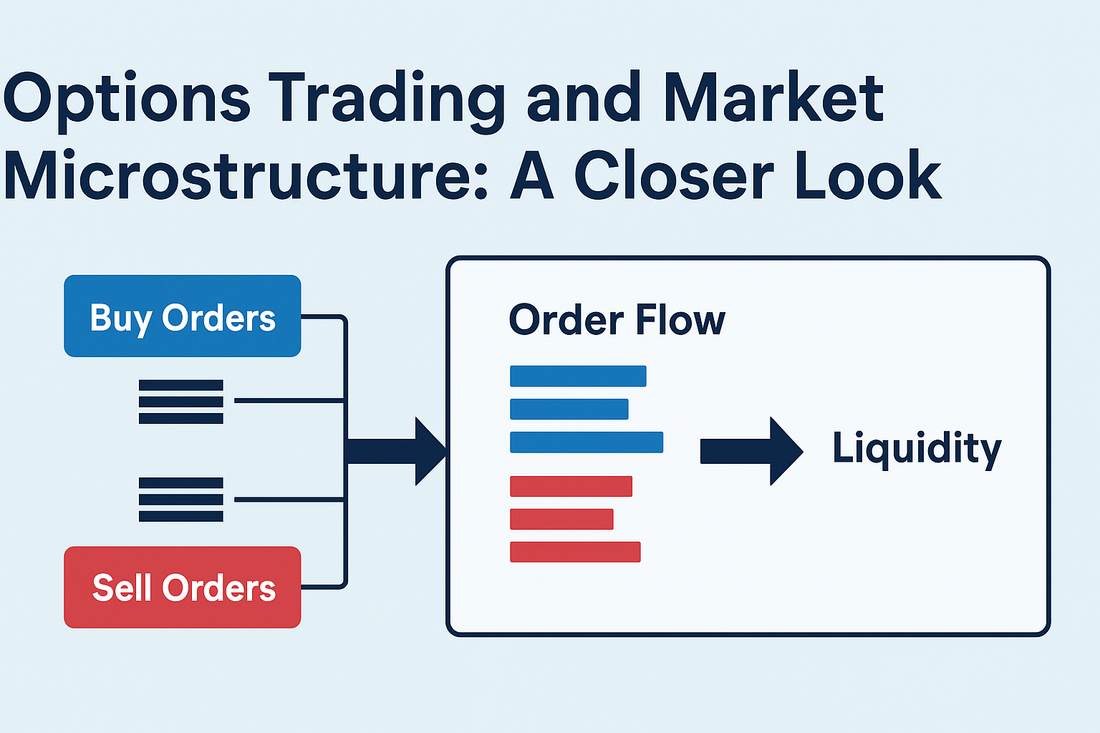

Section 5: Microstructure Diagram

📌 Backlink Opportunity: Creating a Custom Options Dashboard

Final Thoughts

Market microstructure may operate behind the scenes, but its impact is front and center in every options trade you make. From the quality of your fills to the speed of your exits and the structure of your spreads, understanding the mechanics of price formation and liquidity flow gives you a decisive edge.

Don’t just trade the chart — trade the market beneath the chart.

Ready to Trade Smarter — Not Just Harder?

At www.optionstranglers.com.sg we offer:

• In-depth live 1-1 sessions / group classes

• Trade examples and breakdowns

• Community mentorship and support

👉 Ready to upgrade your strategy and trade like a pro? Visit www.optionstranglers.com.sg and start your journey to financial freedom today.

Your future is an option. Choose wisely.

⚠️ Disclaimer:

Options involve risk and are not suitable for all investors. Always consult with a financial advisor before investing.