How to Use Options Trading to Achieve Financial Independence

Overview:

In a world dominated by 9-to-5 routines, rising costs of living, and unpredictable markets, many are seeking a path to true financial independence—where your money works for you, not the other way around. While traditional investing offers a slow and steady path, options trading presents a more dynamic, accelerated route. When approached with discipline, education, and a long-term mindset, options trading can be a strategic pillar on your journey to financial freedom.

In this article, we’ll explore how you can use options trading to build income, compound capital, and protect wealth—ultimately creating a roadmap to independence.

🧠 Section 1: A Long-Term Strategy Toward Financial Freedom

1.1 What Is Financial Independence?

Financial independence means having enough income from your investments to cover your lifestyle expenses—without relying on a paycheck.

This requires:

- Consistent income

- Risk-adjusted growth

- Wealth preservation

Options trading can support all three pillars—with strategies tailored to your financial goals and risk tolerance.

📌 Backlink: Explore our Beginner’s Guide to Options Trading

1.2 Why Options Trading Over Traditional Investing?

|

Factor |

Traditional Investing |

Options Trading |

|

Return Speed |

Slower, compounding |

Faster, leveraged returns |

|

Flexibility |

Limited |

Directional, income, hedging |

|

Capital Efficiency |

High capital required |

Control large assets with less |

|

Income Generation |

Dividend-dependent |

Custom income via strategies |

|

Risk Control |

Market-driven only |

Can be structured via spreads |

Options trading gives control—you choose your risk, reward, and trade structure.

1.3 Building a Vision With Options

A long-term options trading plan includes:

- Monthly income goals

- Growth targets

- Defined risk strategies

- Milestones for scaling capital

You’re no longer just investing for retirement—you’re designing a lifestyle.

📌 Backlink: Learn how to build a trading plan from scratch

💰 Section 2: Generating Income With Options

2.1 Covered Calls – The Foundation of Passive Income

Strategy:

- Own 100 shares of stock

- Sell a call option against it each month

Goal:

- Collect premium as recurring income

- Reduce cost basis over time

- Maintain upside exposure (limited)

Example:

Own AAPL at $170

Sell a $175 call for $2.00 → collect $200 income

📌 Backlink: Learn the covered call strategy in detail

2.2 Cash-Secured Puts – Get Paid to Buy Stocks

Strategy:

- Sell put options on stocks you’d like to own

- Collect premium while waiting for the stock to fall

Goal:

- Earn while accumulating

- Enter positions at a discount

Example:

Sell a $100 put on MSFT for $3 → keep $300

If MSFT drops, you’re assigned at $97

2.3 Iron Condors – Income From Sideways Markets

Strategy:

- Combine a bear call spread + bull put spread

- Profit from time decay in range-bound markets

Goal:

- Earn non-directional income

- Capital-efficient for retirement accounts

Perfect For:

- Weekly income

- Passive volatility harvesting

📌 Backlink: Learn to profit in flat markets

2.4 Diagonal Spreads – Blending Time and Direction

Strategy:

- Buy a longer-dated option

- Sell a near-term option at a different strike

Goal:

- Generate income while holding directional bias

- Reduce cost basis on long-term trades

2.5 Scaling Income Over Time

- Start small: 1–2 monthly trades

- Compound returns into larger positions

- Use profits to diversify or reinvest in longer-term spreads

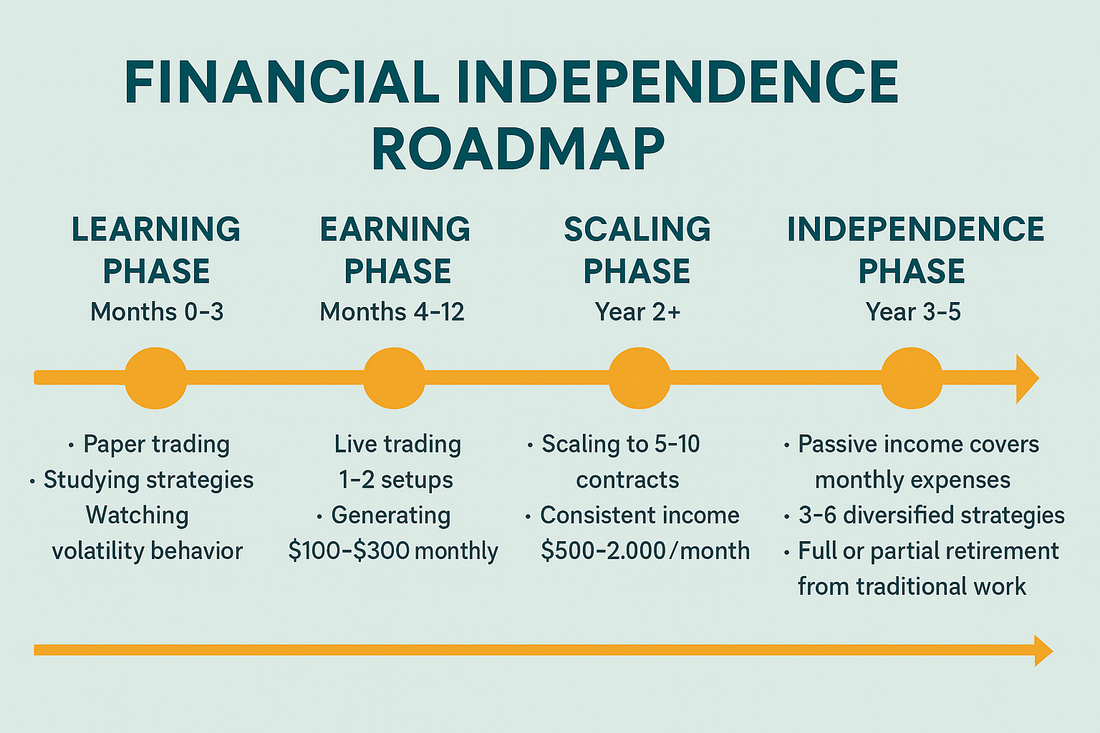

📊 Section 3: Financial Roadmap (Illustration Description)

[Graphic: Financial Independence Roadmap]

📌 Backlink: See how to transition from learner to full-time trader

📈 Section 4: Real Case Studies – Options Trading for Freedom

Case Study 1: Jason, 35 – Tech Worker Turned Trader

Goal: Retire early by 45

Plan: $300/month in options income → scaled to $2,000/month in 3 years

Strategy: Covered calls + put spreads on tech ETFs

Result: Replaced 70% of income via trading

Case Study 2: Lina, 42 – Part-Time Trader, Full-Time Mom

Goal: Supplement income post-career break

Strategy: Diagonal spreads on low-beta stocks

Result: Averaged $1,000/month with 3 trades/week

Case Study 3: Daniel, 52 – Early Exit from Corporate Job

Background: 25 years in banking

Strategy: Built a ladder of cash-secured puts and iron condors

Result: Covered monthly expenses without touching savings

🛡️ Section 5: Managing Risk on the Road to Independence

✔ Only Use Defined-Risk Trades

- Always know your max loss

- Favor credit and debit spreads over naked options

✔ Never Overleverage

- Stick to 1–2% risk per trade

- Use multiple smaller trades vs. one large position

✔ Maintain a Trading Journal

Track:

- Entry & exit

- Strategy rationale

- Emotions

- Mistakes and improvements

📌 Backlink: Manage your options trading journal

✔ Diversify Strategies and Timeframes

- Don’t rely on just one income play

- Mix covered calls, diagonals, condors

- Use different expiry lengths

🔗 Internal SEO Backlinks

- How to Trade Weekly Options

- Options for Retirement Planning

- Best Tools and Software for Options Traders

- How to Build a Consistent Options Income Stream

🎯 Conclusion: Trade Your Way to Financial Freedom

Financial independence isn’t just about hitting a number—it’s about building a lifestyle of freedom, flexibility, and confidence in your financial decisions.

Options trading, when used correctly, offers a practical and scalable pathway to get there. Whether your goal is to quit your job, supplement your income, or just feel financially secure, a structured options plan puts you in the driver’s seat.

You don’t need to guess the market. You need a system. You need consistency. And you need a mentor.

✅ Interested to know more?

At www.optionstranglers.com.sg we offer:

• In-depth live 1-1 sessions / group classes

• Trade examples and breakdowns

• Community mentorship and support

👉 Ready to upgrade your strategy and trade like a pro? Visit www.optionstranglers.com.sg and start your journey to financial freedom today.

Your future is an option. Choose wisely.

⚠️ Disclaimer:

Options involve risk and are not suitable for all investors. Always consult with a financial advisor before investing.