A Deep Dive into Binary Options vs. Traditional Options

Introduction

Options trading has become a go-to strategy for investors seeking leverage, hedging capabilities, and non-linear returns. Among the many types of options available, two forms often generate debate and confusion: binary options and traditional options. While they both share the word "option" in their name, they operate on vastly different principles, risk profiles, and legal frameworks.

In this article, we will demystify these two instruments by comparing their definitions, mechanics, benefits, and limitations. If you're on a mission to become a self-sufficient trader and leave the rat race behind, understanding the difference between binary options and traditional options is crucial for building a sustainable, informed trading approach.

Section 1: Definitions

1.1 What Are Traditional Options?

Traditional options—also called vanilla options—are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price before or at expiration.

There are two basic types:

- Call Options – Provide the right to buy the underlying asset.

- Put Options – Provide the right to sell the underlying asset.

These contracts are traded on regulated exchanges (e.g., CBOE, NYSE, SGX) and offer flexible strategies ranging from directional plays to income generation and hedging.

Key components of traditional options:

- Strike price

- Expiration date

- Premium (cost of the option)

- Underlying asset

- Option type (call or put)

💡 Backlink: Learn more from our beginner guide on Introduction to Options Trading.

1.2 What Are Binary Options?

Binary options are a different beast entirely. They are structured as all-or-nothing contracts where the outcome is a fixed return (usually 70–90%) or a complete loss of the premium.

Binary options ask a simple question:

Will the price of an asset be above or below a certain level at a specific time?

- If you are correct → you get a fixed payout.

- If you are wrong → you lose your stake.

These contracts are generally traded over-the-counter (OTC), although some platforms offer exchange-traded versions.

Key features of binary options:

- Fixed payout

- Short timeframes (minutes to hours)

- Simple Yes/No outcome

- Typically not available on major U.S. exchanges

Section 2: Key Differences Between Binary and Traditional Options

|

Feature |

Binary Options |

Traditional Options |

|

Underlying Asset |

Often indices, forex, commodities |

Stocks, ETFs, indices, currencies |

|

Outcome |

All-or-nothing (win full or lose all) |

Profit/loss scales with market movement |

|

Time Frame |

Short (minutes to hours) |

Flexible (days to years) |

|

Payout |

Fixed return (e.g., 80%) |

Varies by price movement and Greeks |

|

Risk Management |

Limited control—stake is always at risk |

Can hedge, roll, or exit early |

|

Regulation |

Often unregulated or lightly regulated |

Heavily regulated (CBOE, OCC, MAS, etc.) |

|

Trading Venues |

Mostly OTC via online brokers |

Listed exchanges and brokerages |

|

Liquidity |

Low, market-maker dependent |

High on active names |

|

Use Case |

Speculation only |

Speculation, income, hedging |

|

Profit Potential |

Capped |

Unlimited (calls) or significant (puts) |

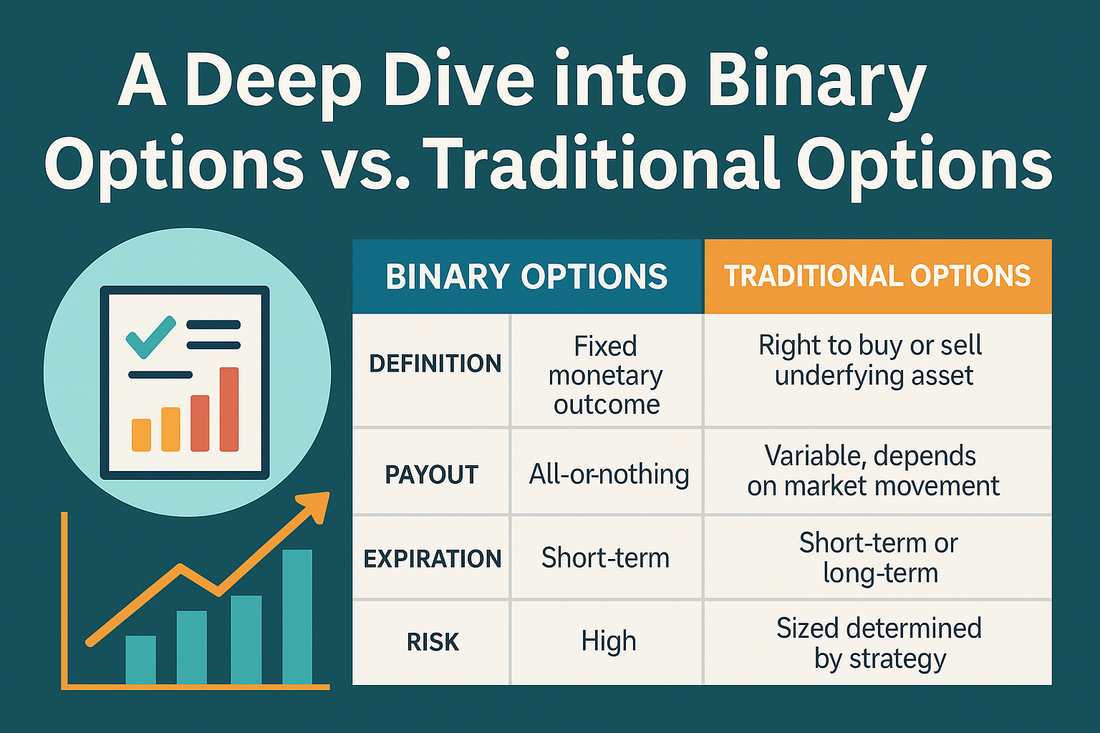

📊 Illustration: [Infographic: Binary Options vs. Traditional Options – Side-by-Side Comparison]

Section 3: Pros and Cons of Each

3.1 Pros of Traditional Options

✅ Strategic Flexibility

Traditional options allow for an infinite range of strategies—from simple directional bets to complex spreads.

✅ Defined Risk with Asymmetric Reward

Buyers risk only the premium but can benefit from large price moves.

✅ Regulation and Transparency

Listed on regulated exchanges with clear risk disclosures, providing trader protections.

✅ Hedging Use

Traditional options are commonly used by institutions to hedge portfolios and mitigate downside.

💡 Backlink: See Leveraging Options for Portfolio Hedging to learn how.

3.2 Cons of Traditional Options

❌ Complexity

Understanding Greeks, expiration cycles, and multi-leg setups requires time and training.

❌ Slippage and Execution Risk

Especially in thinly traded options, bid-ask spreads can eat into profitability.

❌ Requires Active Management

Successful trading often involves frequent adjustments and analysis.

3.3 Pros of Binary Options

✅ Simplicity

Just predict Yes/No—no need to understand time decay, Delta, or implied volatility.

✅ Fixed Risk and Reward

You know the outcome in advance. Great for new traders who want certainty.

✅ Quick Results

Fast expiration times mean faster decisions and (potentially) quicker profits.

3.4 Cons of Binary Options

❌ High Risk of Loss

You lose 100% of your stake if you’re wrong—even by 0.01%.

❌ No Exit or Adjustment

Once the trade is placed, you're locked in until expiry.

❌ Limited Regulation

Many binary brokers operate offshore and lack financial oversight. Fraud is a serious concern.

❌ Capped Profits

Even when you win, the return is fixed—usually less than 100%, despite risking 100%.

Section 4: Regulatory Overview

4.1 Traditional Options

Traditional options are regulated by institutions such as:

- SEC and FINRA in the U.S.

- MAS (Monetary Authority of Singapore) in Singapore

- Options Clearing Corporation (OCC) – ensures trade settlement and clearing

These markets offer legal recourse, account protection, and enforcement of trading rules.

4.2 Binary Options

Binary options have faced significant legal scrutiny:

- U.S. SEC and CFTC have banned retail binary options offered by offshore firms.

- European Securities and Markets Authority (ESMA) banned binary options in the EU.

- Singapore considers most retail binary options as unregulated investments.

In short: Binary options are often illegal or heavily restricted for retail traders in many jurisdictions.

💡 Backlink: Stay compliant by reading Navigating Regulatory Changes in Options Trading.

Section 5: Which Is Better for You?

5.1 For Long-Term Traders

Traditional options win hands down. They allow for capital growth, income generation, and portfolio defense.

5.2 For Short-Term Speculators

Binary options offer adrenaline-fueled action but with high risk and no room for error. If you're not prepared to lose your entire position in seconds, they are best avoided.

5.3 For Self-Sufficient Traders

If your goal is to build wealth and achieve financial freedom, traditional options are the superior tool. They reward skill, patience, and strategy—not luck or last-minute price spikes.

Section 6: A Word of Caution on Binary Options Scams

The binary options world is rife with scams, especially in the form of:

- Fake brokers promising guaranteed returns

- Signal services offering 90% accuracy

- Automated bots that drain accounts

- Bonus schemes that lock your funds

Always verify if the platform is licensed by a respected financial authority. When in doubt—walk away.

🚨 Tip: No legitimate trading platform guarantees profits. If it sounds too good to be true, it probably is.

Section 7: How to Get Started the Right Way

Step 1: Educate Yourself

Master the foundations of options trading before deploying real capital. Use platforms with demo accounts and study real-world trade examples.

💡 Backlink: Start with our free content on A Step-by-Step Guide to Launching Your First Options Trade.

Step 2: Choose a Reputable Broker

For traditional options, consider brokers like:

- ThinkOrSwim by TD Ameritrade

- Interactive Brokers

- Tastytrade

- Saxo (for Singapore-based traders)

Avoid brokers that only offer binary products with unclear terms.

Step 3: Paper Trade and Journal

Before going live, use a simulated account and maintain a detailed trading journal.

💡 Backlink: Learn more in Managing Your Options Trading Journal.

Conclusion: Traditional Options Are the Smart Path to Financial Freedom

Binary options may appeal to those chasing quick profits, but they rarely deliver consistent returns—and often operate in murky legal waters. On the other hand, traditional options offer a regulated, flexible, and strategic way to trade the markets, whether your goal is income, protection, or speculation.

If you're serious about becoming a self-sufficient trader, mastering traditional options is a far more reliable path. You’ll gain the tools, knowledge, and confidence to navigate any market condition—and edge closer to financial independence.

📣 Find Your Edge

At www.optionstranglers.com.sg we offer:

- ✅ In-depth live 1-1 sessions / group classes

- 📊 Trade examples and breakdowns

- 👥 Community mentorship and support

👉 Ready to upgrade your strategy and trade like a pro?

Visit www.optionstranglers.com.sg and start your journey to financial freedom today.

Your future is an option. Choose wisely.

⚠️ Disclaimer:

Options involve risk and are not suitable for all investors. Always consult with a financial advisor before investing.